SGIS Smart Cash is a solution designed for money market investors as an alternative to certificates of deposits.

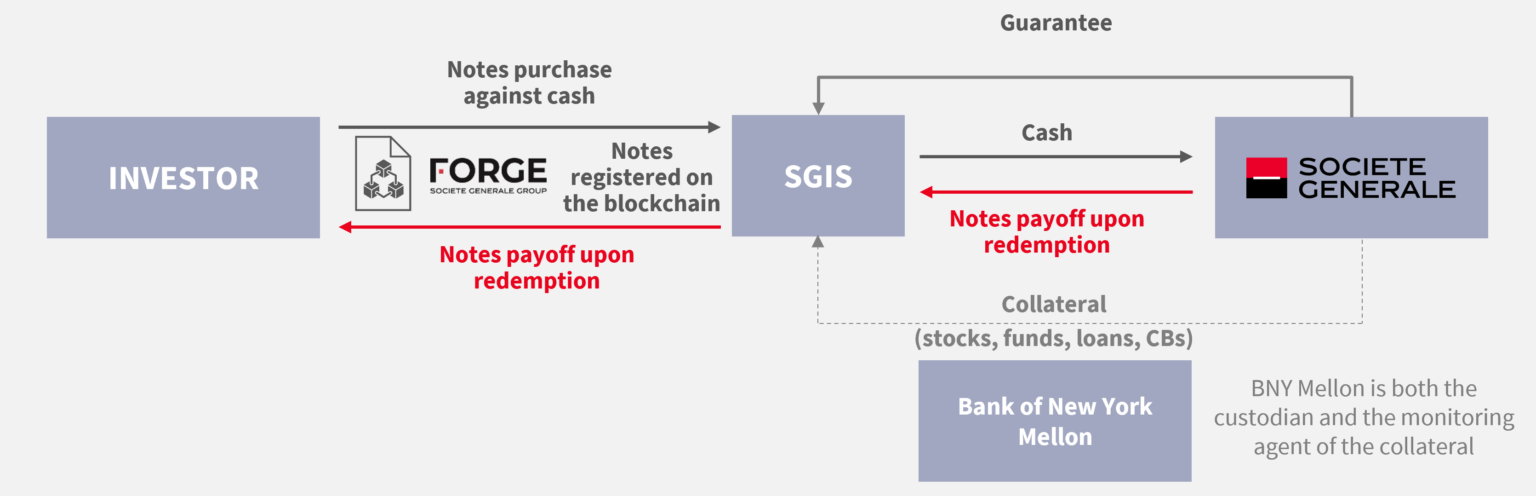

The EMTN are issued by SG Issuer (“SGIS”), a member of SG Group incorporated in Luxembourg, and collateralized by assets held at BNY Mellon SA/NV, Luxembourg branch.

The notes are registered on public blockchains (Ethereum public or Tezos) by Societe Generale-FORGE acting as Registrar on behalf of the issuer SGIS.

These securities in the form of tokens (the Security Tokens) are characterized as debt securities and financial instruments under MIFID II and, in that respect, benefit from the same legal framework and conditions than traditional securities. The Security Tokens have the potential to significantly improve efficiency, speed, and transparency in capital markets and make transactions safer and more resilient.

SGIS Smart cash offers both high liquidity and a high level of security.

The notes can be redeemed early at the option of the investor or the issuer with a pre-agreed notice.

Secondary market is available with a T+2 settlement cycle through a liquidity letter for Daily Notes.

Amounts due under the notes are guaranteed by Societe Generale.

The independent collateral monitoring agent, BNY Mellon, London Branch, controls every day that the value of the collateral is superior or equal to the pre-agreed percentage of the accrued value of the notes.

Issuer: SG Issuer – Debt Instruments issuance Programme – French law – Registered form.

Payoff types: Reference Rate or Fixed Rate Notes.

Underlyings: usual money market rate (SOFR, ESTR, etc.).

Currency: EUR, USD, GBP…

Available blockchains: Tezos and Ethereum public blockchains.

For further information, please contact your usual business partner at Societe Generale Corporate and Investment Banking.